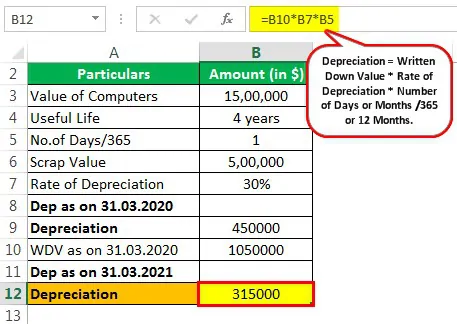

Double Declining Balance (Method of Depreciation) | Double Declining Balance | By IGCSE Accounting Private | Hey there Welcome back to accounting stuff I'm James and in this video, I'll show you

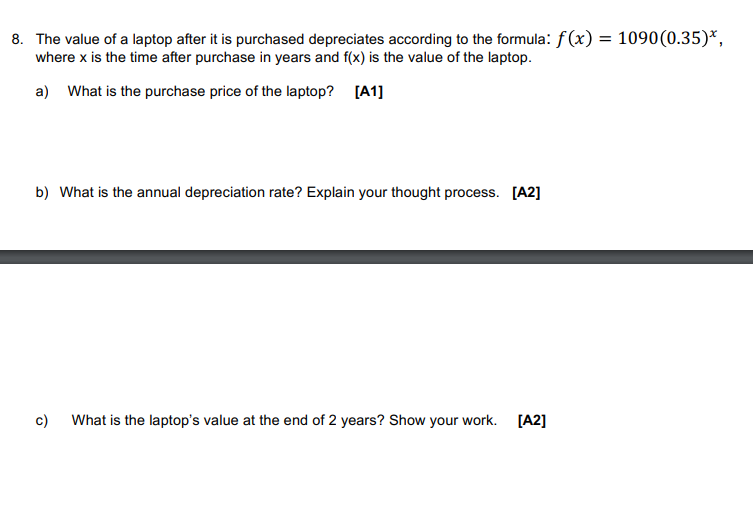

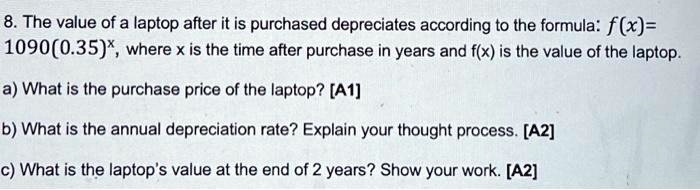

SOLVED: 8. The value of a laptop after it is purchased depreciates according to the formula: f (x)= 1090(0.35)*, where x is the time after purchase in years and f(x) is the

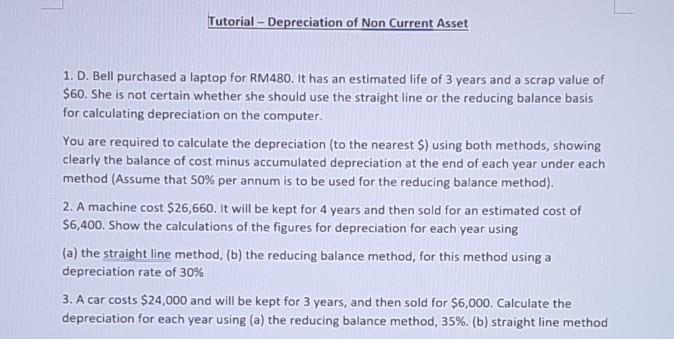

SOLVED: College Mathematics 5 points Rhonda bought a new laptop for 800. The laptop depreciates, or loses, 20% of its value each year. The value of the laptop at a later time

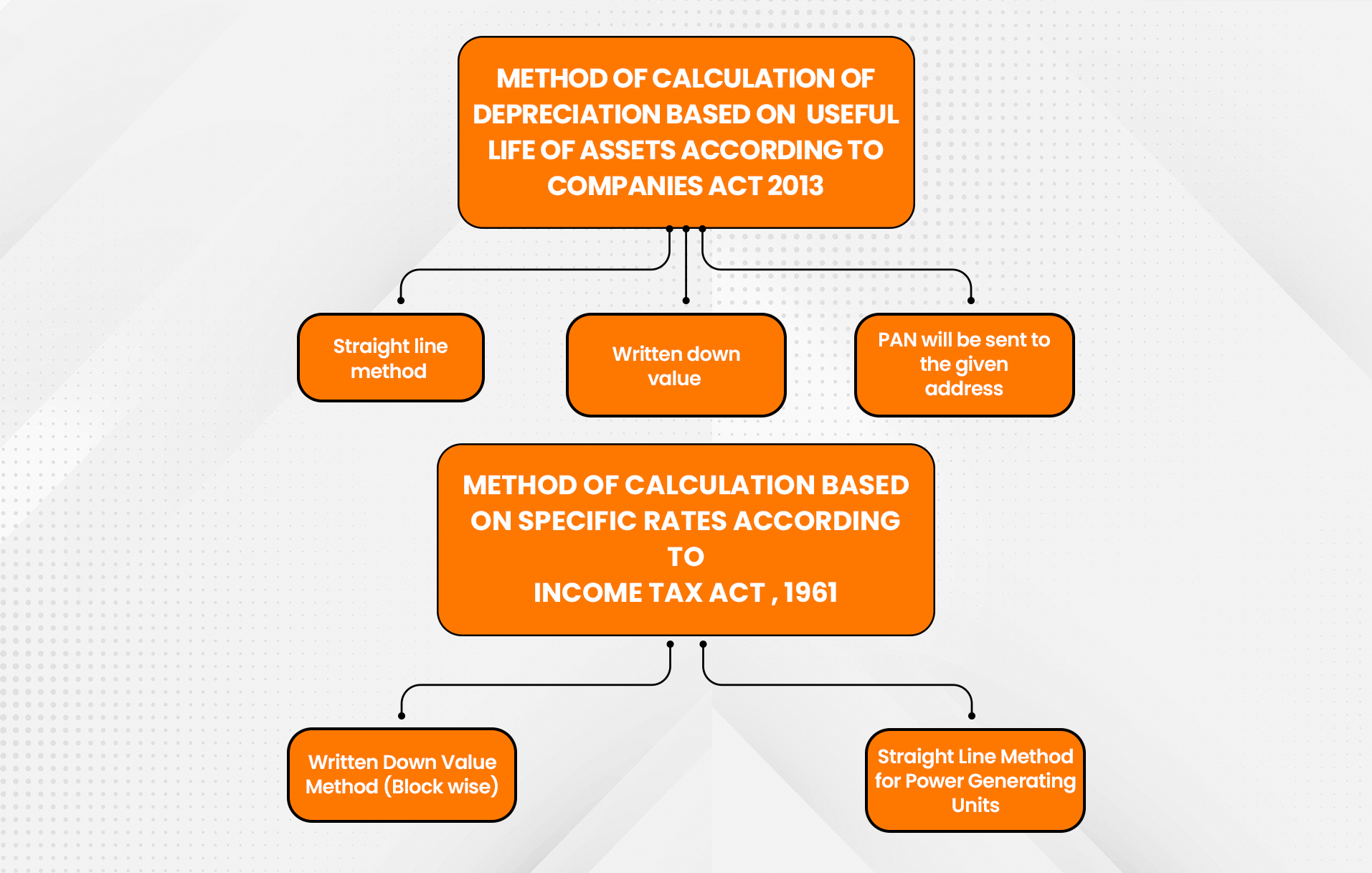

Depreciation on Software calculated at Rate of 25% Instead of 60%: Delhi HC upholds Deletion of Disallowance under Income Tax Act

Max Weinbach on X: "So there's no set depreciation rate of MacBook Airs. This website estimates 17.1% over the first year, 36.1% over three. That means a $1900 MacBook Air is worth

The graph represents the relation between the laptop values and the time. The average rate of change (in dollars per year) of the value of laptop over the five-year period is